Salary vs Hourly: What’s the Difference and Benefits for Employee

-

Kate Borucka

- September 25, 2023

- 9 min read

Which is better — salary vs hourly employees? There’s a significant distinction between how they get paid and how they work. Both types come with advantages and disadvantages and differ in the salary range, depending on the industry and job category.

What is an hourly position in comparison with salaried positions? What’s the difference, and why it matters? The job market is full of both, and knowing the two variations can help you decide which is better for you, your company, and your lifestyle.

There’s a lot to talk about, so let’s get right to it!

What’s The Difference Between Salary and Hourly Pay?

The U.S Department of Labor (DOL) has specific guidelines regarding hour laws and employee compensation that should be included in an employment contract. It directs regulations on fair pay. And when it comes to salary and hourly employees, it also has very specific rules.

The Fair Labor Standards Act (FLSA) requires that “most employees in the United States be paid at least the federal minimum wage for all hours worked and overtime pay at not less than time and one-half the regular rate of pay for all hours worked over 40 hours in a workweek.”

Commonly, there’s one main difference between the two:

-

Salaried employees are paid a fixed income for their job (a fixed payment for an agreed period)

-

Hourly employees get as much money as many hours they’ve worked (based on the number of hours worked and agreed hourly wages)

However, the FLSA includes the rules for exempt employee billing – they can’t receive overtime compensation.

However, it can get tricky, so let’s get deeper into details so you can better understand the differences between a salaried employee and an hourly employee.

Salary Employees

Salaried employees receive a set amount of money that is calculated on an annual basis. The compensation can’t be under the federal minimum wage set by the Fair Labor Standards Act. The pay period can be monthly, weekly, biweekly, or have any other frequency set by the contractor and the employee.

Additionally, salaried employee always receives the same pay regardless if they’re hired for full-time positions or if they work less or more than 40 hours in a week.

The most important thing is that employees perform all their tasks on time and stick to their responsibilities.

Overtime Pay

Usually, salaried workers don’t receive compensation for overtime. No matter if they work more or less than 40 hours per week, they must be paid the minimum wage.

Salaried employees might be exempted from overtime pay, under the FLSA, if they hold a particular position with specific duties (positions considered exempt include executive, professionals, computer, administrative, and outside sales) or their weekly income isn’t less than $684. Industries like insurance software development play a crucial role in streamlining operations, enhancing data management, and improving customer service, making it an essential aspect of modern business strategies.

Clocking In

Salary employees aren’t obliged to clock in. That’s because they are always paid the same amount of money no matter the number of hours they worked in a week.

Nevertheless, many employers decide to use a clock-in clock-out system to track employee attendance, monitor project profitability, and improve workflow.

Also, some employees decide to monitor work hours for personal reasons—to improve productivity, track the progress of projects, or to learn how many hours they spend on work each day.

Overall, tracking time for salary employees is not obliged by the law.

Benefits

Another important aspect of salaried workers is that they are entitled to employee benefits. Not only do they have steady paychecks every month, but also have the right to paid vacation time, sick and personal leave, health insurance, dental insurance, 401(k) retirement plans, and others. For example, CPA’s salary typically includes comprehensive benefits packages and compensation such as access to retirement savings plans, health insurance, bonuses, and other types of incentives depending on the industry and employer.

Hourly Employees

Hourly employees are paid hourly wages for each hour of work. They receive pay for the hours they work and aren’t entitled to a salary paycheck. Hourly workers often prefer a flexible schedule; they can work as many hours in a week as they want or need to. They’re often freelancers and part-time employees working for many different contractors.

Also, by working in hourly positions, they are non-exempt employees, which means that, next to earning the federal minimum wage, they’re entitled to overtime pay.

Overtime Pay

Hourly workers must receive overtime pay if they work more than 40 hours a week. Overtime wages should be at least one and one-half times the regular rate.

Note that the rate for overtime is the same even if hourly workers spend extra time working during weekends, holidays, or regular days of rest.

However, when receiving an hourly wage, employees may not be entitled to overtime pay if it is stated in the labor contract. That depends on the employer.

So if you work on an hourly basis, it’s best to agree on the overtime and include the right statement in the contract. That way you’ll avoid working extra hours for free. Make sure to refer to the U.S Department of Labor and FLSA to prove your rights.

Clocking In

The FLSA requires that hourly employees must clock in and out. They have to track their time or log work hours in timesheets. Such data is often used as proof of work and can be audited by proper authorities.

Clocking in is necessary to make sure that both employee and employer comply with the law and to calculate pay for every hour worked (including scheduled hours and extra pay for additional hours).

Additionally, it’s forbidden by federal law for workers to perform duties outside the contract and receive payment under the table. The U.S Department of Labor oversees regulations to ensure fair pay and treatment for all employees, so as an hourly employee, you should be aware of your rights.

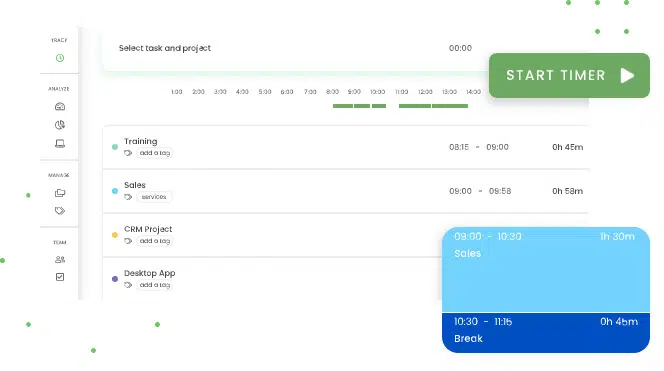

Don’t waste time filling your timesheets manually.

⏱ Clock in/out automatically with TimeCamp for free.

Benefits

Unlike salaried employees, workers who receive hourly pay aren’t entitled to benefits unless they become full-time employees. In this case, they can receive the benefits.

According to the IRS (Internal Revenue Service) Affordable Care Act, a full-time employee is a person who works an average of 30 hours per week, for a calendar month or 130 hours per month.

It may also happen that a company will offer some form of benefits for an hourly employee, but it all depends on the employers.

Exempt or Non-Exempt?

There’s a lot of confusion around exempt and nonexempt employees. While it may be difficult to state clearly from the Fair Labor Standards Act which is which, the difference is actually quite easy.

If you’re still not sure whether you’re or hire exempt or nonexempt employees, here’s a quick cheat sheet:

- Exempt employee receives a salary rather than hourly pay and isn’t entitled to overtime pay under the FLSA

- A Nonexempt employee is paid for overtime hours by the FLSA and usually receives hourly pay

Sometimes, whether a person is an exempt or nonexempt worker depends also on the employer and provisions in the work contract. Consultants play a crucial role in helping businesses navigate these classifications and ensure compliance with labor laws

💡 Important note: although the FLSA is very specific about exempt and nonexempt employees, ensure that you’re following the right state laws and guidelines. Especially, there are different exemptions, so make sure not to put everyone in the same boat. If you’re in doubt, consult law professionals who will help you clear out the problem.

Getting Paid Salary vs Hourly

Calculating paycheck is the most difficult aspect of hiring employees. Whether you’re an employer or an employee, there are two ways to calculate a paycheck.

Hourly vs Salary Calculator

Calculating pay for an hourly worker is easy. If you earn $20 per hour and work 40 hours per week, then your weekly paycheck is $800.

However, if you receive a salary pay, then it gets more complicated. You need to take your annual salary and divide it by the number of pay periods in a year (these can be weekly, bi-weekly, monthly, bi-monthly, etc.). This gives you a salary for every pay period.

However, the easiest way to calculate paycheck for salary employees is to use a dedicated calculator. It’ll help you determine the precise rate per hour. Some hourly vs salary calculators take into account such details as deductions, taxes, and other values.

The right tool will help you determine whether it’s best to work as an hourly or salary employee.

⇒ Read also: Top 7 Free Payroll Calculators

Time Tracking

Since clocking in is obligatory for hourly employees, it’s much easier to calculate it automatically than to add all numbers in manual timesheets. One of the most popular forms of the employee clocking in is time tracking software.

Why use time tracking software to calculate hourly wage? Because it lets you save time and money on manual calculations. It also has many benefits for both the employee and employer:

- It automatically tracks work hours up to the second

- It lets you set an overtime rate of time and a half the regular hourly rate

- You can set different hourly wages for different tasks and projects

- Automatic time tracker eliminates tedious paperwork and manual timesheet filling

- All time records are kept in neat timesheets with accurate time logs

- You can share reports and timesheets with clients, stakeholders, managers

- Track billable and non-billable hours

- Time tracking ensures you comply with federal regulations

- You can track time and access all the data from any place (with web, desktop, and mobile apps)

- All your reports and timesheets are stored in one place so it’s easy to have proof of work in case of audits

- Attendance and timesheet management in one place

- Easy invoicing

- Integrations with other tools to improve your workflow

Get all these features for free in TimeCamp — a free time tracker for salaried and hourly employees!

You can also track time as a salaried worker to find out how much time you spend on tasks and projects, and whether you’re being productive. It’ll help you better assess your workflow and decide if it’s a good idea to switch to an hourly wage.

What Are The Benefits of Salary vs Hourly?

There’s no one-size-fits-all formula for defining whether it’s better to be a salary or hourly employee. Both salaried and hourly employees can experience benefits and have equal career advancement opportunities.

To help you see the clear picture of both, here are the benefits and negative sides of receiving salary vs hourly pay.

✔ Benefits of Salary Employee

+ Fixed regular paycheck: you always know what you are going to be paid. The paycheck is the same regardless of vacation, sick leave, slowdown at work, etc.

+ No obligation to work extra time: since you’re not entitled to overtime, you don’t have to work for the hours you’re not going to get paid for.

+ Employee sponsored benefits: salaried employees are entitled to numerous benefits.

+ Influence: salaried jobs are considered as more responsible and impactful than hourly jobs; sometimes it can be helpful to peak the career, especially in larger companies and corporations.

❌ Disadvantages of Salary Employee

– No pay for extra work: if you work for more than 40 hours a week, you don’t receive pay for overtime hours.

– Risk of losing work-life balance: being employed in a salaried position, you’re paid for the work you do. For that reason, it may happen that you’ll have to work extra hours or take work home to finish your tasks on time. As a result, you can find it more difficult to set a boundary between work and personal life.

– Less autonomy: as a salaried employee, usually you can’t choose who you work with. You’re stuck with one manager and can’t set your rules for how and when you work.

✔ Benefits of Hourly Employee

Hourly workers have many benefits so take a look before you decide to become a salaried employee:

+ Overtime pay: it’s one of the biggest advantages. For every extra hour of work, you must be paid an overtime rate of time and a half the regular hourly rate.

+ More autonomy: in most cases, you have a lot of flexibility in how, when, and with who you work. You also choose how many hours you work and at what time.

+ Better career choice: as your own boss, you can choose who you want to work with and on what terms. You’re more open to new opportunities, especially, if you don’t work full-time. There are many companies and specific niches that want to work with hourly contractors.

+ Flexibility: you can set your own schedule and work during your productivity zone, be it an early morning or the middle of the night. You can also travel while working or work from home.

❌ Disadvantages of Hourly Employee

– Unstable paycheck: since you’re paid for the number of hours you’ve worked, you need to ensure a regular income, which may not always be easy.

– No paid time off: as an hourly worker, you don’t get paid when you go on vacation or sick leave. You need to make up for the lower pay if you decide to take time off.

– Higher risk of unemployment: employers usually prefer salaried to hourly workers so it may not always be easy to find a gig. Also, in times of economic crisis, such as the coronavirus pandemic, the risk of being employed as an hourly worker rises.

Hourly vs Salary—Which Is Better for You?

The two types of employment have advantages and disadvantages. The job title and pay may be the same in both cases, and what matters most is which one you prefer. Consider all the pros and cons and decide which is better for you.

After all, some people will feel better working 8 hours a day in the company headquarters, while others will prefer to work hidden deep in the woods in a cozy cottage. How do you prefer to work?

February 17, 2023 at 21:02

Good day! This is my first visit to your blog! We are a team of volunteers and starting a new project in a community in the same niche. Your blog provided us valuable information to work on. You have done a wonderful job!